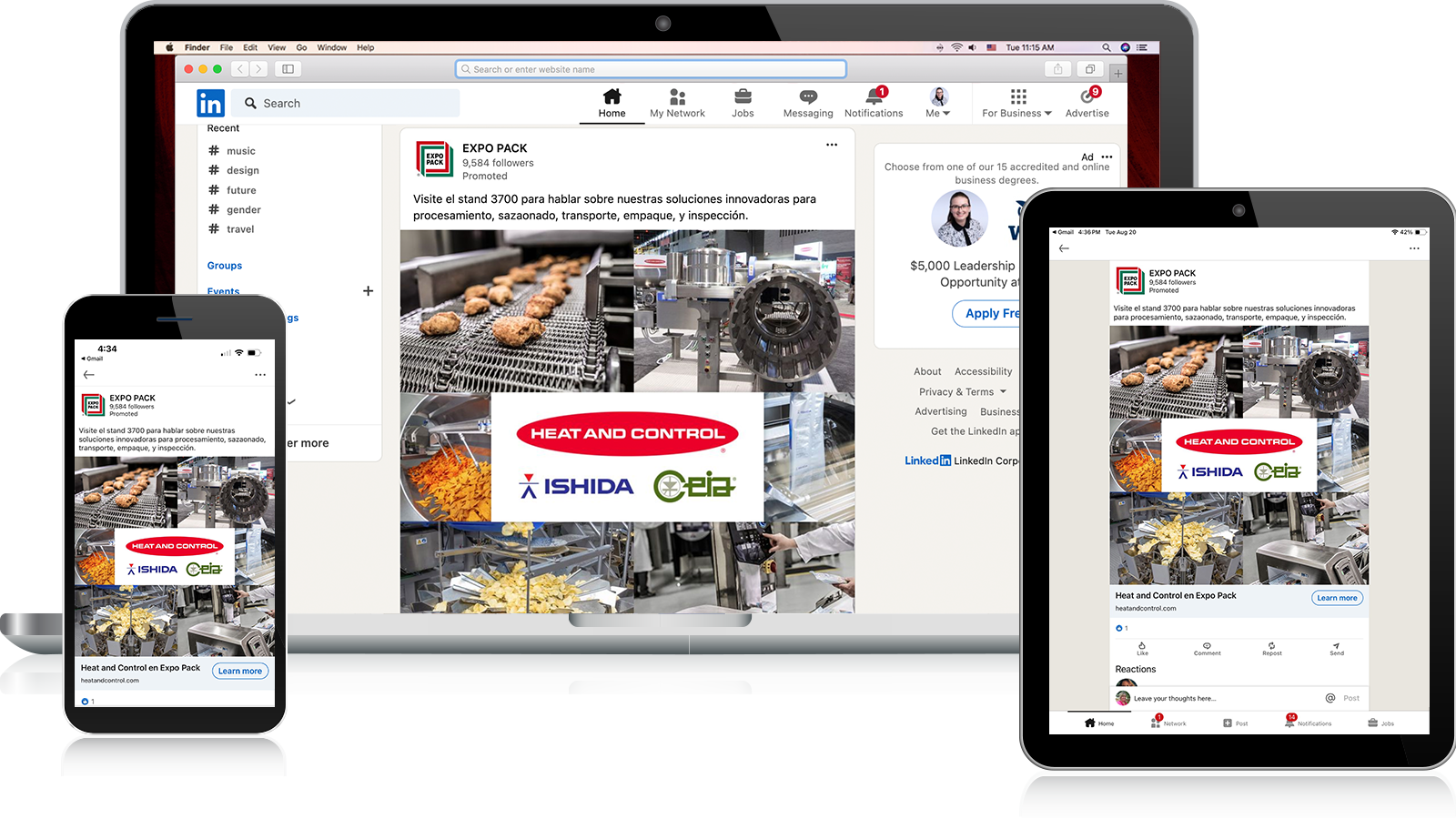

Capture EXPO PACK buyer attention through LinkedIn. Leverage exclusive, interest-based audience data to deliver your message directly to pre-registrants before the show.

Pre-registered EXPO PACK attendees consuming content on their LinkedIn feeds.

Distribution will vary based on PACK EXPO registration rates.

Build awareness for your exhibit among EXPO PACK pre-registered attendees as they browse their LinkedIn feeds via LinkedIn Sponsored posts.

Advertisers exhibiting at EXPO PACK, looking to drive booth traffic, and traffic to a specific URL.

4 sponsors per two week period.

For up to date inventory, please use the tools below:

Common objection: Can't we run our own LinkedIn ad campaigns?

Absolutely—you can run your own LinkedIn campaigns. However, PMMI Media Group is the only source of the official EXPO PACK pre-registrant list. There is no other way (through LinkedIn or other media groups) to reach this verified audience of EXPO PACK attendees. Rather than waste your time or budget on incorrect targeting, partner with PMMI Meida Group to have confidence in who your ad is reaching.

Q. Why is inventory limited for PMMI Audience Network products?

A. Here is a great presentation on Joan regarding this topic. In summary, inventory for LinkedIn and Facebook is limited because they serve ads through a per-impression auction where ads targeting the same audience and format compete based on bid and relevance. Competition increases with the more ads targeting the same audience. When competition increases—especially if we run multiple PMG campaigns to the same individuals—CPMs rise, and with fixed budgets that means fewer impressions and weaker performance across campaigns. To prevent self-competition and protect delivery, we cap inventory based on testing that balances maximum available reach with stable campaign results.

Q. Why are the pageviews that are reported by Google Analytics not matching up with the number of clicks reported by LinkedIn?

A. Site attribution and traffic reporting are not perfect, and discrepancies between platforms are expected. In fact, it’s typical to see LinkedIn report 15% to 40% more clicks than GA4 sessions. This gap stems from several factors, including differences in how clicks and sessions are measured, tracking delays, privacy filters, and non-human activity. Google has published multiple explanations for these mismatches, and LinkedIn itself acknowledges the presence of invalid traffic through its HUMANverification partnership.

Q. Can you give us a brief overview on our process for eliminating bots and non-human impressions?

A. LinkedIn/Facebook are in control over the reporting and eliminating or bots/non-human impressions. We do not know what their policy is and cannot provide any information regarding those policies. What we can control and comment on is that we upload our audience to LinkedIn. We do not use the find look alike audience expansion feature that LinkedIn has, so it is indeed just our known first party audience.

Q. How does LinkedIn optimization work with a PMG audience?

A. When we create a social campaign, we provide LinkedIn with the list of our selected audience and tell LinkedIn that this is who we'd like to reach with this ad. LinkedIn can identify the people on our list, which is where the "match" occurs. These are names both within our system and LinkedIn's. Due to this, LinkedIn has action data on these individuals from our list—whether an individual watches video ads regularly, clicks often, or is more likely to comment. When we hand our audience list over to LinkedIn, we tell LinkedIn the type of person we want to reach—a clicker, a watcher, or a commenter. They then serve the ad to individuals on the list we provided who have the highest probability of completing that action. LinkedIn only allows us to optimize for one action (clicking, watching, or commenting) for a campaign.

Q. Why do we optimize videos for views and posts for clicks?

A. For video campaigns, we optimize for views because the goal is to get end-users to watch their video. This is their opportunity to get in front of our audience for an extended period of time and share a detailed message about why they should choose the advertiser's solution. When they provide a video we want to show it to people that are more likely to watch videos, so they have the opportunity to tell their full story. For static campaigns, it's Clicks, impressions, and reach because that product's goal is to get people to click.

Q. Can we give leads for Mundo campaigns?

A. Even though we cannot give lead information, commenters have been very engaged (such as “give me details” or “more information”) and advertisers can reach out to those commenters on their own through LinkedIn.

$1,450 (1/3 of the current year price)

Notes on hard cost: The reason that PW, PFW and Mundo hard costs are slightly less than OEM and HCP hard costs (even though all brands are priced the same) is because PW, PFW and Mundo campaigns are likely to start with bigger lists and we want to make sure that we maintain performance with HCP and OEM which will have list overlap with PW, PFW and Mundo lists. When we’re bidding for names we want to give HCP and OEM a competitive advantage over PW, PFW, and Mundo because of their smaller list sizes.